- Home

- INVESTOR RELATIONS

- For individual investors

For individual investors

Inbound demand and market growth are driving factors

~ Our group's growth metrics continue to expand ~

For the fiscal year ending September 2024, despite ongoing challenges such as the yen's depreciation, rising prices, and an unstable international situation, domestic economic activity was supported by the government's wage increase initiatives and the rise in inbound tourists. The cashless payment market, which our group focuses on, also expanded steadily, driven by the increasing need for cashless payment adoption and labor-saving solutions among merchants due to inbound demand and labor shortages.

Our group actively pursued the acquisition of new merchants and strengthened alliances in line with this trend, further solidifying our revenue base. As a result, our payment platform expanded, and our business performance and key performance indicators (KPIs) continued to show steady growth.

Moving forward, our group remains committed to improving social and customer convenience by promoting the adoption of cashless payments. We sincerely appreciate your continued support and cooperation.

Financial highlights

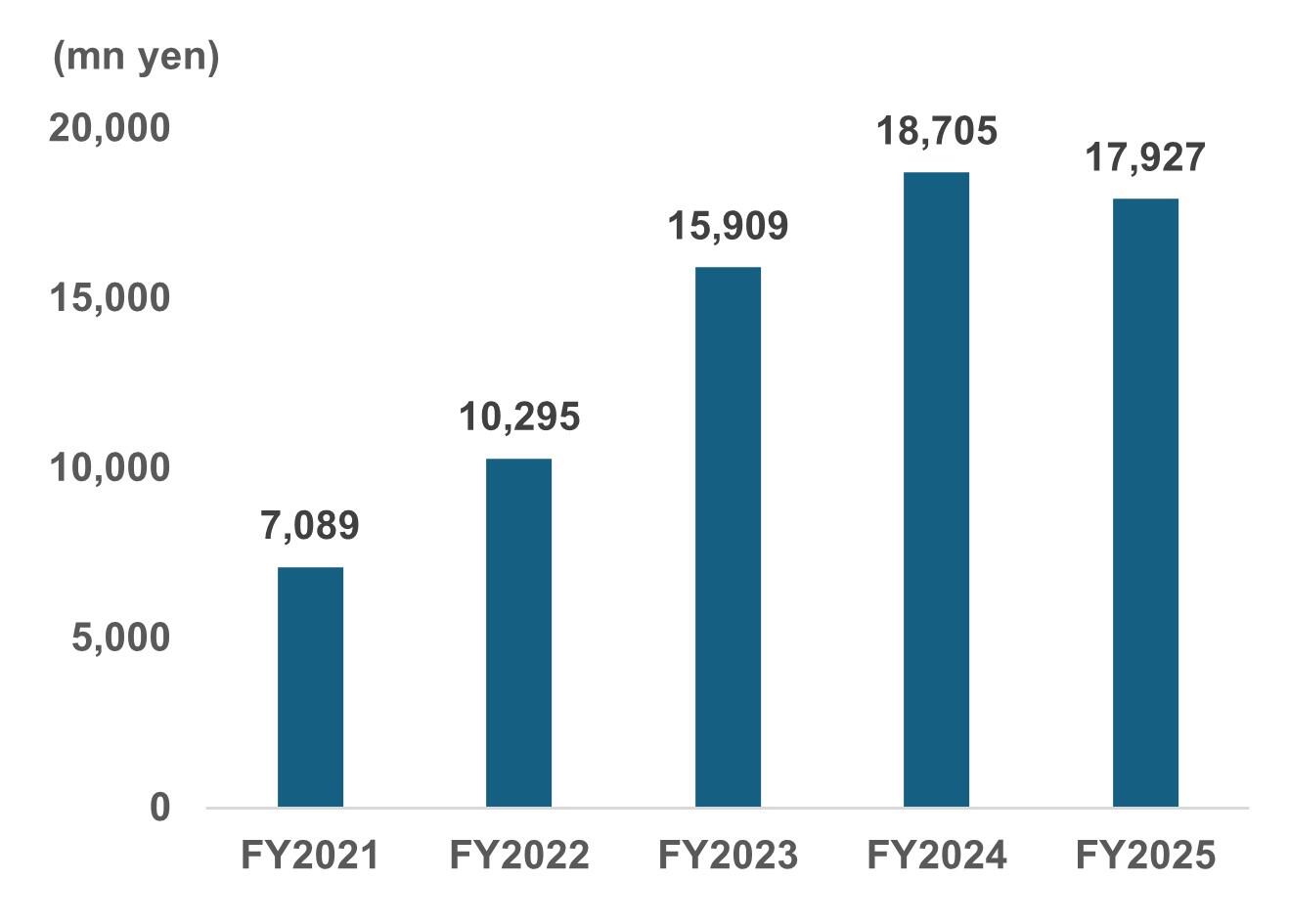

Revenue

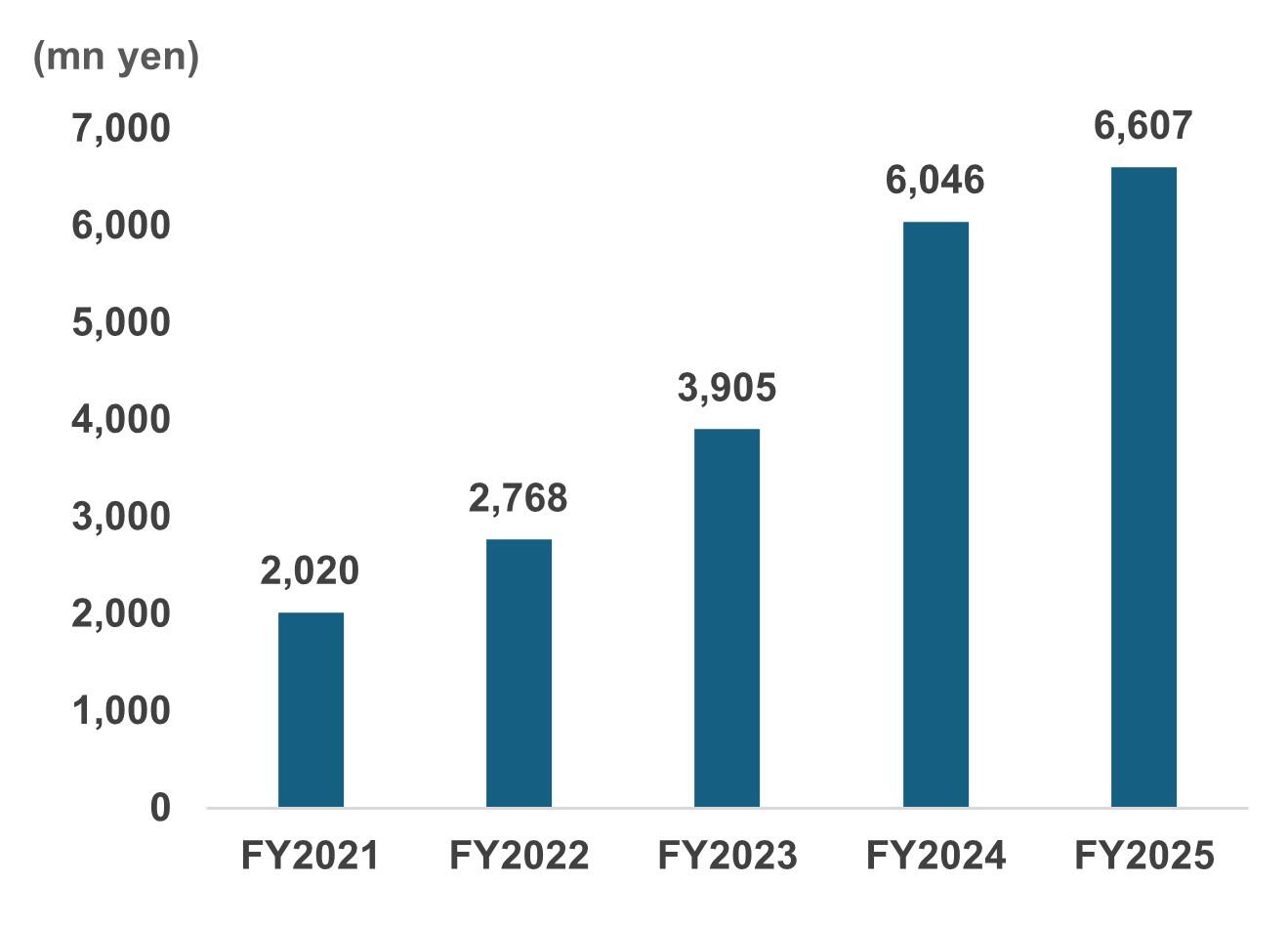

Gross profit

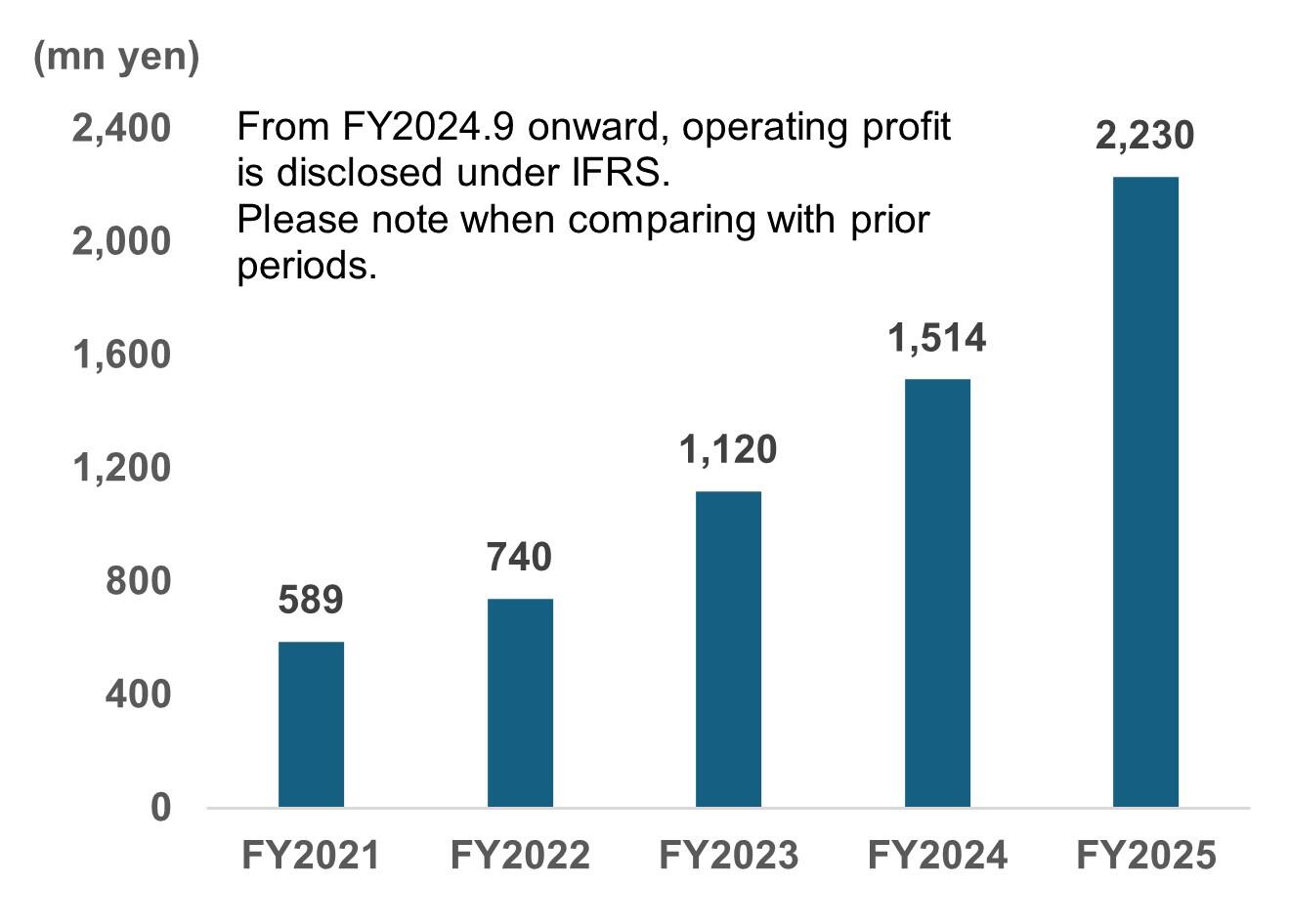

Operating profit

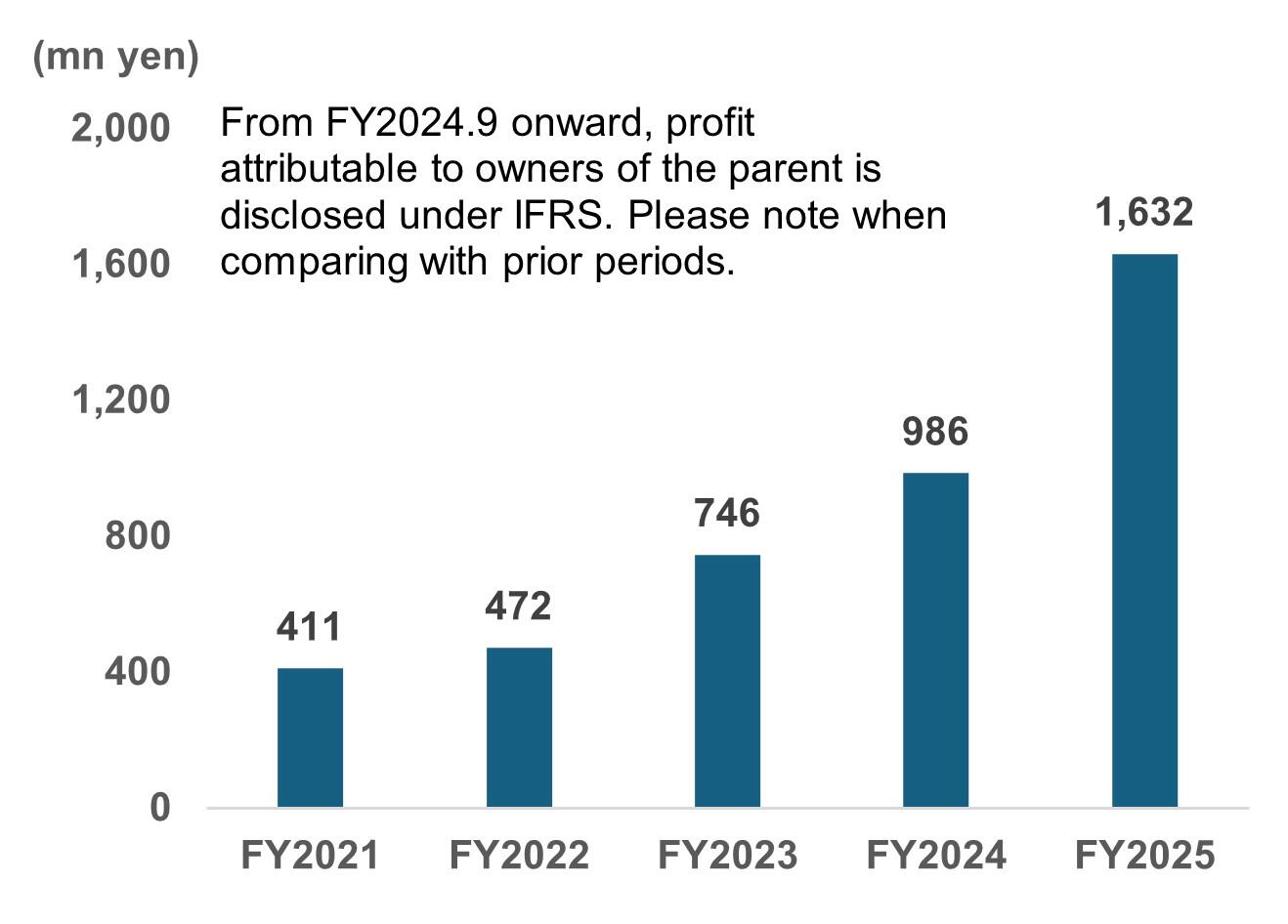

Profit attributable to owners of the parent

KPIs

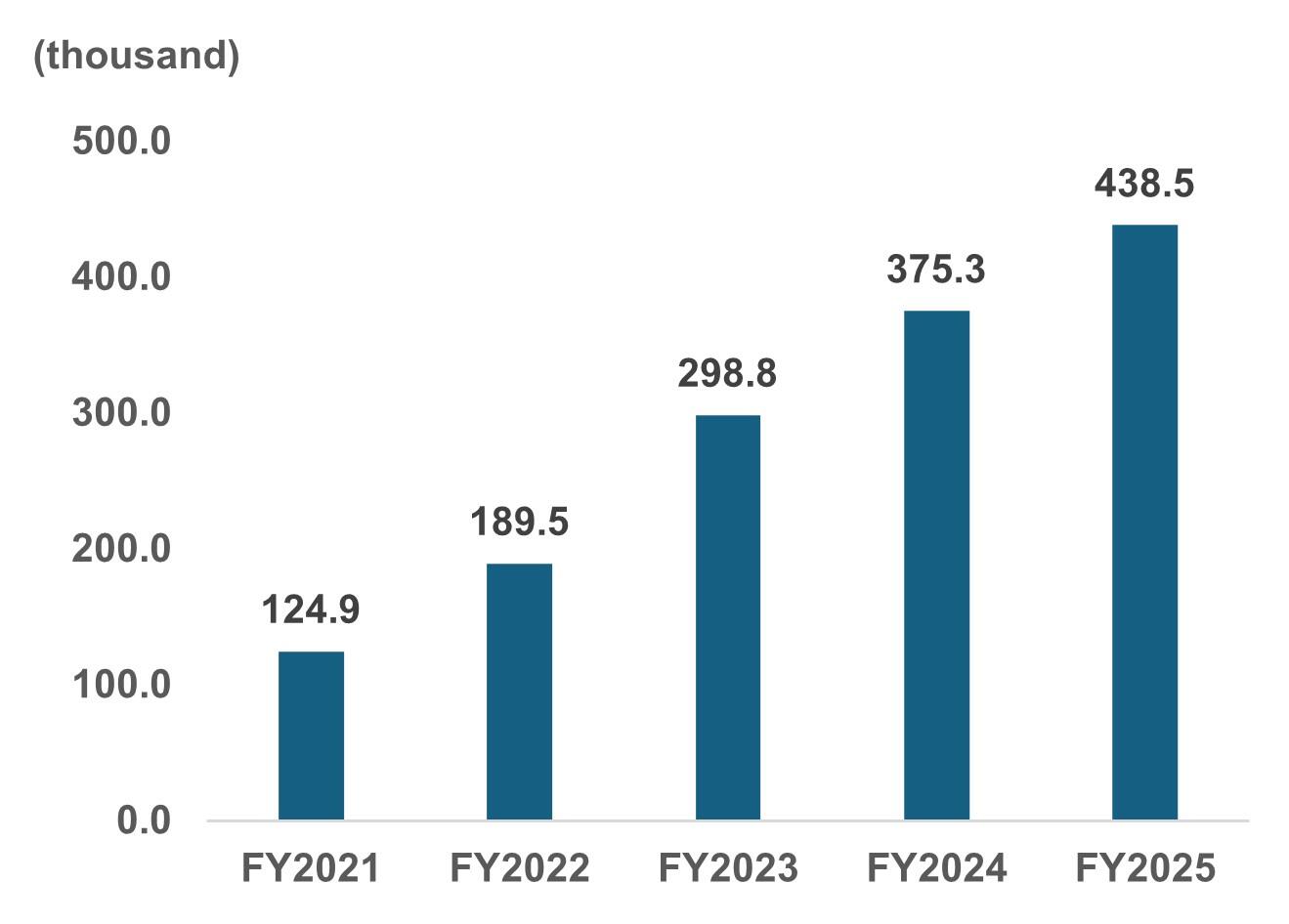

Number of active IDs

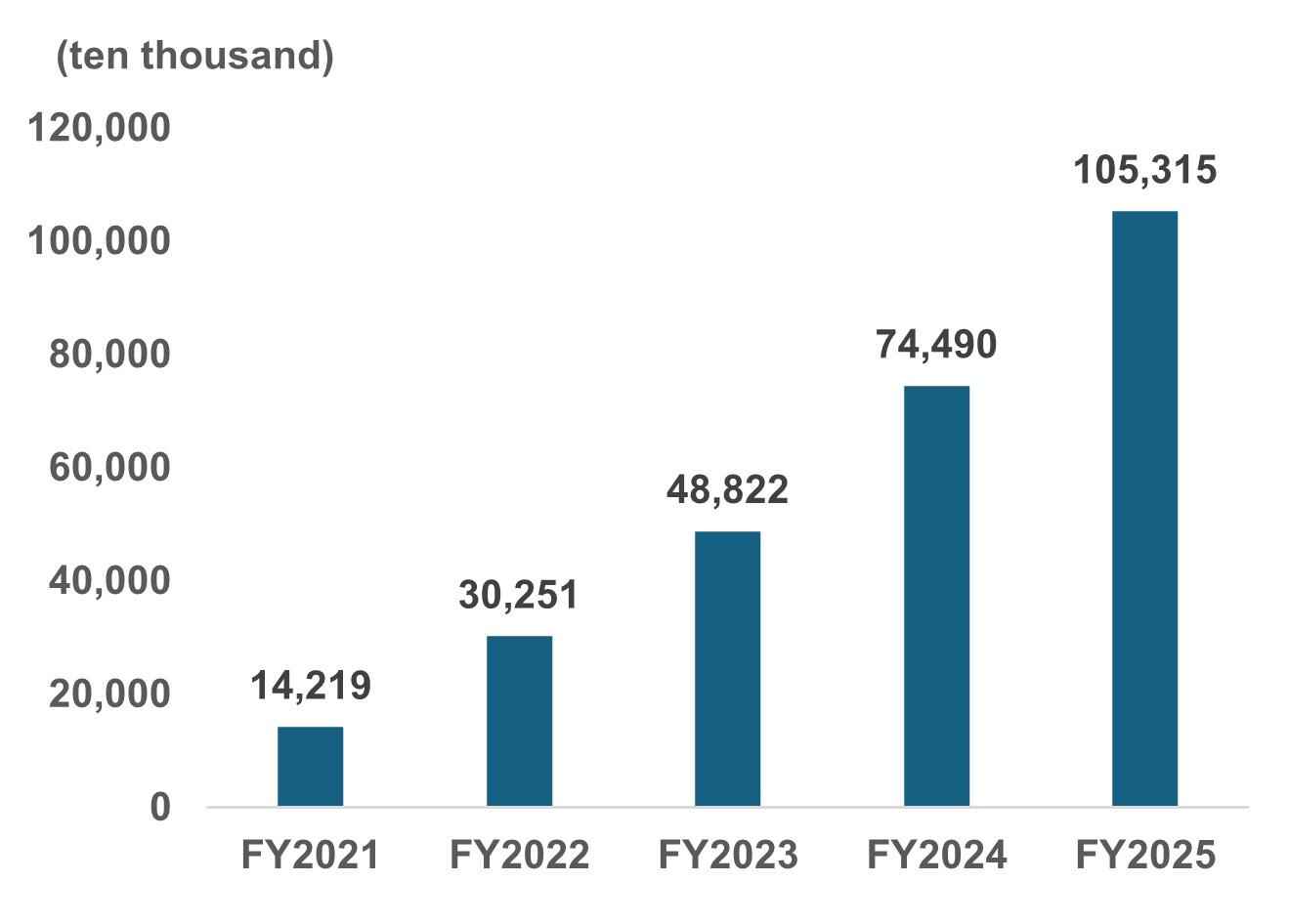

Transaction volume

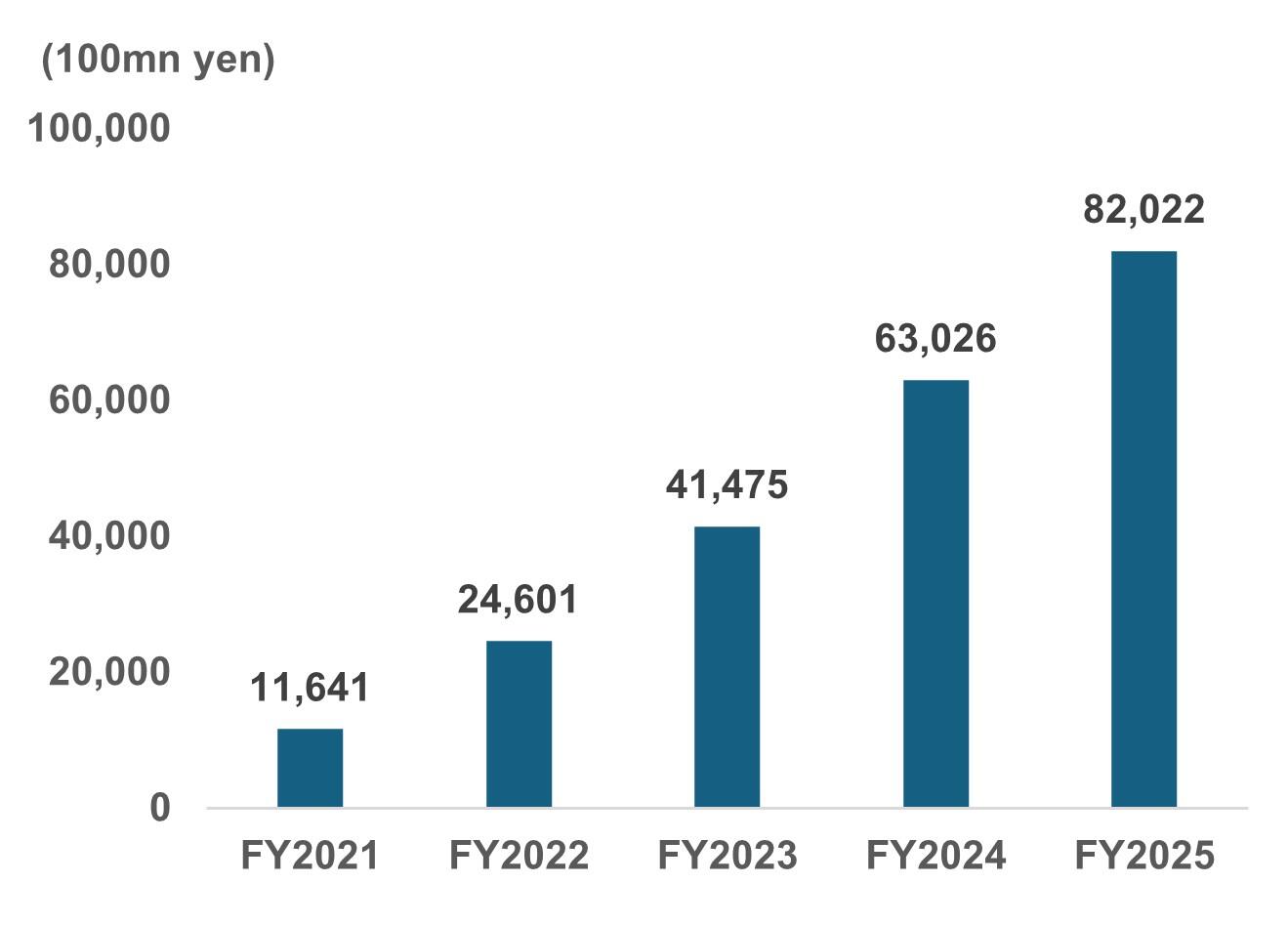

Transaction value (GMV)

Total addressable market

The market size of face-to-face cashless payments in Japan is steadily expanding, supported by government initiatives. Currently, Japan's cashless payment ratio stands at 39%, a relatively low figure compared to other developed countries. However, the Japanese government has implemented various measures aimed at increasing this ratio to 40% by 2025 and 80% in the long term.

Events and trends such as the Tokyo Olympics, the COVID-19 pandemic, and the rise in foreign tourists have contributed to the gradual adoption of cashless payments in Japan. Moving forward, milestones like the introduction of new banknotes and the Osaka Expo are expected to further boost the cashless payment ratio.

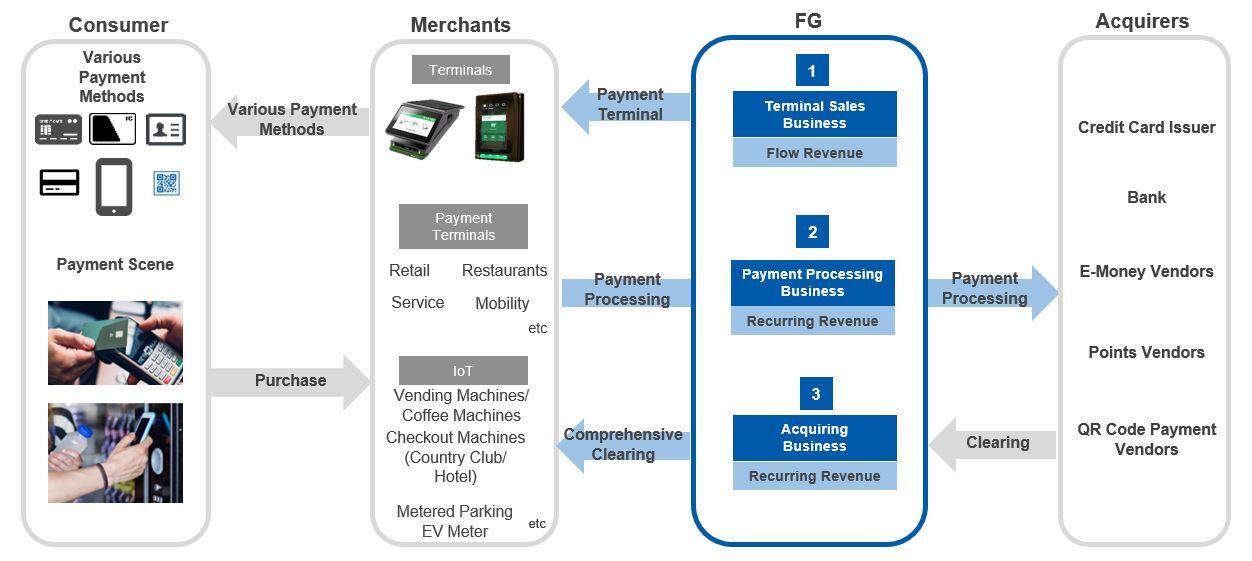

Business model

Our group provides the infrastructure necessary for face-to-face cashless payments through a one-stop service. Centered on our core payment center business, we handle the entire face-to-face cashless payment process, from upstream payment terminal operations to downstream acquiring services.

Revenue model

Our group records four revenue categories across three business segments. We are focused on expanding recurring revenue while using flow-based revenue as a hook to acquire new merchants. We consider the current period as a time for market share expansion, prioritizing long-term profit growth through market acquisition rather than short-term profit margin maximization.

As a result, initial revenue from the payment terminal business currently accounts for approximately 60% of total revenue. This reflects our strategy to expand market share, which will serve as the foundation for future growth in recurring revenue and improved profitability.