- Home

- SUSTAINABILITY

- Governance

Governance

Basic way of thinking

Our group aims to achieve fair and transparent management. To achieve this, we will build good relationships with all stakeholders, including our shareholders, customers, business partners, local communities, and employees, and promote management activities that aim to improve the group's corporate value from a long-term perspective.

Management efficiency, soundness, and transparency are essential to increasing the group's corporate value, and we believe that these are the basic elements of corporate governance and recognize them as important management issues. To this end, we are working to enhance corporate governance in compliance with laws and regulations by establishing a decision-making system that responds quickly and appropriately to changes in the business environment and a fair, transparent, and efficient business execution system, while maintaining appropriate relationships with all of our stakeholders.

From the viewpoint of further enhancing corporate governance by strengthening the supervisory function of the Board of Directors, the Company has shifted to a company with an Audit and Supervisory Committee System at the Ordinary General Meeting of Shareholders held on December 17, 2023.

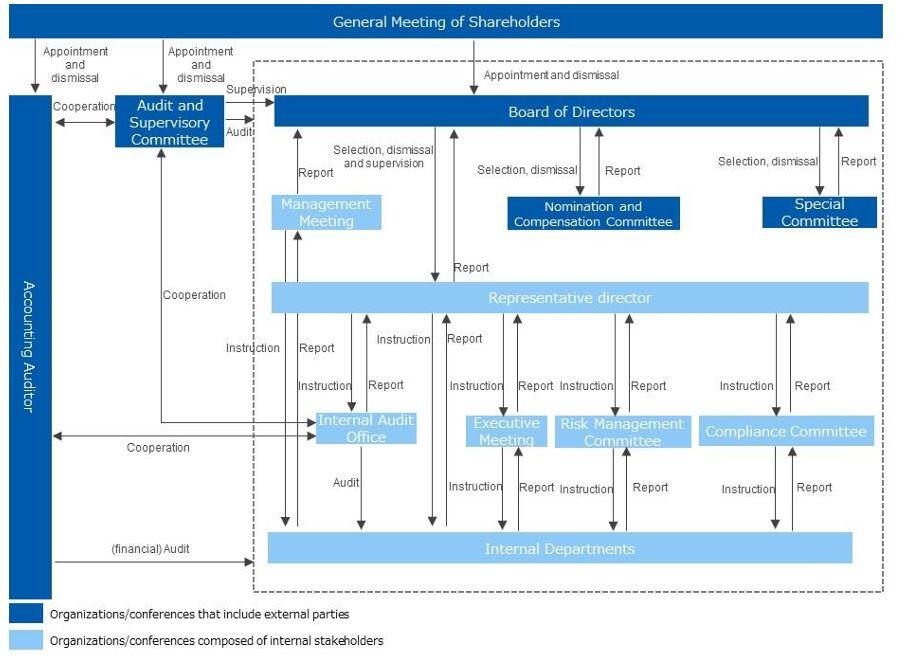

Corporate Governance Structure Chart

Board of Directors

The Board of Directors consists of nine directors (including four outside directors) and is positioned as the highest decision-making body to deliberate and decide on basic management policies, important decisions, and important matters stipulated by law. In principle, the Board of Directors meets once a month, and when important proposals arise, the meeting is held as necessary. The Company's Articles of Incorporation stipulate that the Company shall have no more than 11 directors.

Audit and Supervisory Committee

The Audit Committee consists of four members (including four outside directors) who are Audit Committee members, and in principle meets once a month, and other times as necessary. The Audit Committee members audit the execution of duties by directors (excluding those who are Audit Committee members) by attending meetings of the Board of Directors and other important meetings and by investigating business and financial conditions.

Management Meeting

The Management Meeting has been established as a body to deliberate and make decisions on important management matters that do not fall under the criteria for approval by the Board of Directors, thereby creating a system that enables flexible management decision-making. The Management Meeting is composed of executive directors and meets twice a month in principle, or as necessary.

Nomination and Compensation Committee

The Nomination and Compensation Committee is a voluntary committee concerning the nomination and compensation of directors and consists of five directors (including three outside directors). In principle, the Nomination and Compensation Committee meets four times a year. As an advisory body to the Board of Directors, the Nomination and Compensation Committee deliberates on director selection policies and compensation amounts from an objective and fair perspective, and reports to the Board of Directors.

Special Committee

The Special Committee is an advisory body to the Board of Directors and consists of four independent outside directors. The committee deliberates and reviews important transactions and actions that conflict with the interests of controlling shareholders and minority shareholders in order to protect the interests of minority shareholders and strengthen the governance of the Board of Directors.

Executive Meeting

The Executive Meeting, consisting mainly of executive directors and corporate officers responsible for business, meets once a week in principle to share the status and schedule of each business unit activity, align the vector of management activities under the direction of management, and ensure speedy business management and flexible organizational response.

Internal Audit Office

The Internal Audit Office has been established to conduct internal audits, and under the direction of the Representative Director, conducts necessary audits and investigations on a regular basis to extensively verify the appropriateness and efficiency of business execution and the status of compliance with and maintenance of the risk management system. The results are reported to the Representative Director, who manages the progress of the internal audit and other functions, and the results are reflected in the management. The Internal Audit Office has one full-time manager, and in accordance with the Internal Audit Regulations, employees outside the Internal Audit Office can be temporarily appointed as audit staff as needed to provide support.

Accounting Auditor

The Company has entered into an audit contract with EY Ernst & Young ShinNihon LLC, and in addition to regular accounting audits, the Company consults with and reviews important accounting issues as needed. There are no special interests between the Company and EY Ernst & Young ShinNihon LLC or its designated and engagement partners who audit the Company. No auditor has been with the Company for more than seven 7 years.

Risk Management Committee

The committee is chaired by a person appointed by the President and Chief Executive Officer, and includes risk management managers and risk managers from each department. The Risk Management Committee meets once a year and whenever necessary. Led by the person in charge of risk management, the committee examines preventive measures to deal with risks surrounding the Company's management, including information leaks and disaster response, and conducts activities such as reviewing necessary business rules, improving information systems, and thoroughly educating employees. In addition, the Company has publicized and thoroughly enforced a reporting system within the Company in the event of an emergency situation.

Compliance Committee

We have established a Compliance Committee in order to achieve management efficiency in harmony with our management philosophy, further increase shareholder value, and fulfill our corporate social responsibility through fair management based on compliance with laws and regulations. In principle, the Compliance Committee meets twice a year to ensure proper business operations with an emphasis on protecting the interests of users of the Company's services, conducting fair transactions, developing a compliance framework, establishing an internal control system, and properly disclosing the status of management.

Executive compensation

The Company believes that the role of directors (excluding those who are members of the Audit and Supervisory Committee) is to enhance corporate value by formulating management policies and strategies for the entire Group, executing operations, and advising and supervising the execution of operations by employees. The Company believes that the role of directors (excluding those who are members of the Audit Committee) is to enhance corporate value by formulating management policies and strategies for the Group as a whole, executing operations, and advising and supervising employees in the execution of their duties. Based on this, the remuneration of directors (excluding those who are members of the Audit and Supervisory Committee) shall be determined based on their contribution to the Company and their performance. The Board of Directors determines the remuneration of Directors (excluding those who are members of the Audit and Supervisory Committee), taking into consideration their contribution to the Company, length of service with the Company, and contribution to the Company's business performance. On the other hand, remuneration for directors who are members of the Audit Committee is a fixed remuneration determined through discussions by the Audit Committee, which ensures their independence by ensuring that their remuneration is appropriate and not influenced by the company's performance.

Performance-based stock compensation plan (BBT)

The Company has adopted BBT (Board Benefit Trust) as a performance-linked stock compensation system for executive directors. This is an incentive plan in which shares are distributed to directors according to the degree of achievement of annual performance targets, and the company's directors share a sense of profit with shareholders from a medium- to long-term perspective and manage management with stock prices in mind. The content is motivating.

Board of Directors Members

Our governance structure is built around directors with backgrounds in technology and finance.

Skills Matrix of our board members

| Identity | Job title | Practicing GMO-ism* |

Corporate management | System Security | Risk managAement | Legal & Governance | Finance, Accounting & Tax | Sales and Marketing | Investment (M&A) | Financial Business | Human Resource Development and Recruitment, Diversity | ESG & Sustainability |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Kentaro Sugiyama | President and Representative Director | ● | ● | |||||||||

| Akio Aoyama | Director, General Manager, Solution Partner Division | ● | ● | ● | ||||||||

| Tomonaga Fukuda | Director, General Manager, IT Platform Division | ● | ● | ● | ||||||||

| Tomoki Tamai | Director, General Manager, Corporate Support Division | ● | ● | ● | ● | ● | ● | |||||

| Tatsuya Koide | Director | ● | ● | ● |

* GMO-ism refers to the "Spirit Venture Declaration," which is the unchanging goal of the GMO Internet Group. In addition to the “55-year plan,”' it is a general term for the company motto and motto that expresses “executive principles'” and “laws of victory”

| Identity | Job title | Practicing GMO-ism* |

Corporate management | System Security | Risk managAement | Legal & Governance | Finance, Accounting & Tax | Sales and Marketing | Investment (M&A) | Financial Business | Human Resource Development and Recruitment, Diversity | ESG & Sustainability |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nao Shimamura | Director(Audit andSupervisory Board Member) | ● | ● | ● | ||||||||

| Rie Asayama | Director(Audit and Supervisory Board Member) | ● | ● | ● | ● | ● | ● | |||||

| Takayoshi Nagasawa | Director(Audit and Supervisory Board Member) | ● | ● | ● | ||||||||

| Satoru Ozawa | Director(Audit and Supervisory Board Member) | ● | ● | ● | ● |

※ * GMO-ism refers to the "Spirit Venture Declaration," which is the unchanging goal of the GMO Internet Group. In addition to the “55-year plan,”' it is a general term for the company motto and motto that expresses “executive principles'” and “laws of victory”

IR activities

In order to realize the purpose of corporate governance, we aim for more transparent and fair IR activities through timely disclosure of management information and dissemination of information to investors. Specifically, we will hold a financial results briefing session after quarterly results disclosure, and we will post the briefing materials on the TSE Timely Disclosure page and our website so that anyone can quickly check the contents. Doing. In addition, through meetings (1-on-1 meetings, group meetings) with securities analysts and institutional investors after the disclosure of business results, we strive to disclose information fairly and proactively so that the company's actual situation can be accurately understood and judged.

| FY2022 | FY2023 | FY2024 | FY2025 | |

|---|---|---|---|---|

| Financial Results Briefing | 4 times | 4 times | 4 times | 4 times |

| 1-on-1 meeting* | 267 cases | 232 cases | 286 cases | 230 cases |

| Group meetings sponsored by brokerage firms | 3 cases | 3 cases | 7 cases | 15cases |

*1-on-1 meetings include brokerage-sponsored conferences (1-on-1 format)

External Awards

Selected in the emerging market stock category for two consecutive years (FY2023 and FY2024) in the "Companies with Excellent Disclosure Selected by Securities Analysts." We will continue to commit to strengthening dialogue with the market at the management level.