- 2023.12.14

- Others

ESG Initiatives

Our group provides cashless payment services with the aim of creating a more convenient society, based on our corporate philosophy of “supporting customers' value creation with a high level of expertise.''

In addition, based on the idea that “a company is made up of its people,” all executives and employees share the vision of “becoming the No. 1 cashless platform that transforms payments and changes society. We will provide convenient payment infrastructure and contribute to the advancement of cashless payments in Japan.

For our group’s executives and employees, we support their growth as “people” through human resource development and welfare programs, and we are building an organization that moves forward together with us toward the realization of our management goals.

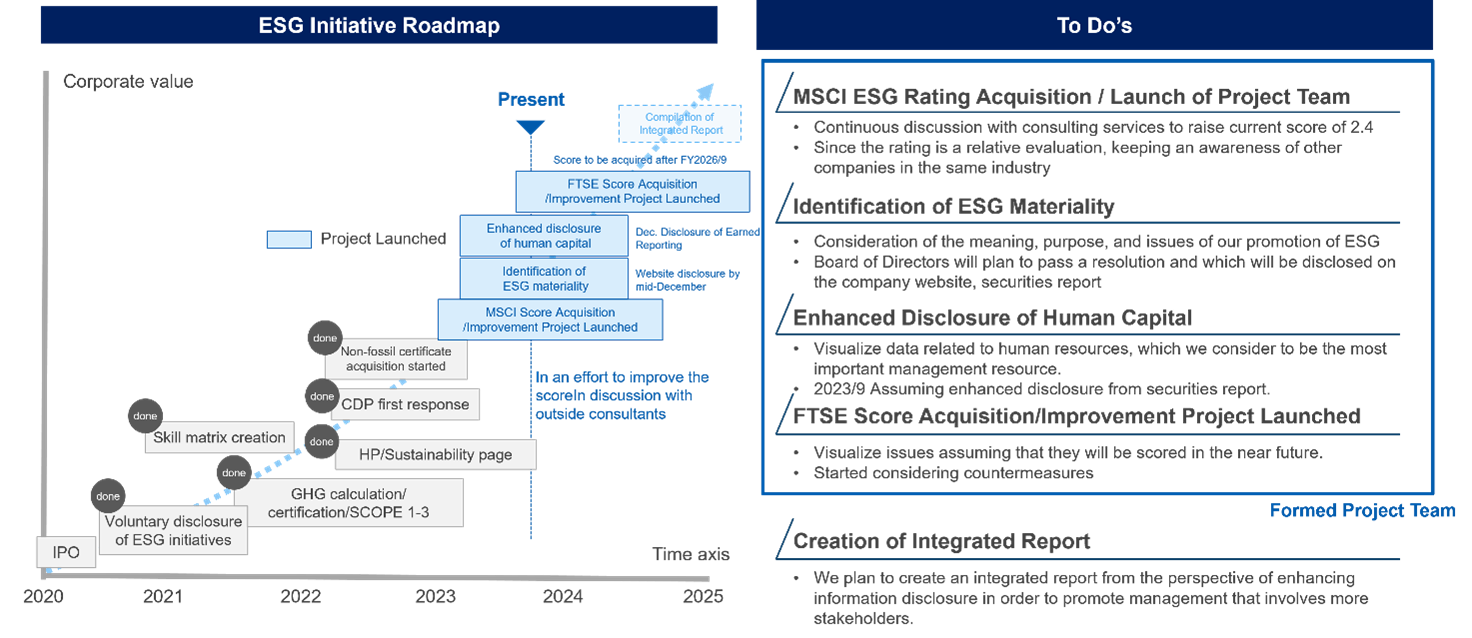

ESG Roadmap and To-Dos

With an eye on continuous improvement of corporate value and future step-up, we are proactively enhancing our governance system and disclosing our human capital.

Materiality

In order to meet the expectations of our stakeholders, based on the "GMO-ism*" shared by the GMO Internet Group, and based on our corporate mission of "transforming payments and becoming the No. 1 cashless platform that changes society," We have identified materiality (important issues) that should be prioritized.

By addressing these important issues, we will realize a society with a lower environmental impact, respond to the declining workforce, revitalize local communities, and create diverse payment styles for consumers by promoting cashless payments in the face-to-face payment market. We aim to both continue contributing to solving social issues and increasing our corporate value.

* GMO-ism refers to the "Spirit Venture Declaration," which is the unchanging goal of the GMO Internet Group. In addition to the “55-year plan,”' it is a general term for the company motto and motto that expresses “executive principles'” and “laws of victory”'

Materiality and identification process

While referring to international indicators such as SASB Standards* , GRI Standards* , and SDGs, and based on the contents of our securities reports, etc., we identify social issues that are highly relevant to our businss that have been extracted. We evaluated the importance from both stakeholder and company business perspectives, and after discussion by the management team, including outside officers, the Board of Directors passed a resolution and identified materiality (important issues).

*SASB Standard: Sustainability Accounting Standards Board Standards for standardizing non-financial information disclosure published in 2018 by the Standards Board.

*GRI Standard: International standards established by the (Global Reporting Initiative).

Used to publicly report on an organization's economic, environmental, and social impacts.

Materiality (important issues) in GMO Financial Gate

Environment

Toward the realization of a society with low environmental impact

Our group is promoting cashless payments, which have a lower environmental impact than cash payments, in the face-to-face payment market, and is working to contribute to the resolution and growth of society and businesses.

As the impact of the new coronavirus infection fades and economic activity begins to resume, our group continues to respond to the increasing cashless payment ratio in Japan, even as reopening progress, including a recovery in inbound tourists from overseas. We will continue to make significant investments and strive to realize a society with a lower environmental impact.

In addition to improving the cashless payment ratio, we also conduct business operations that are environmentally friendly when providing payment platforms. Specifically, the contents are as follows.

・Use of recycled paper for receipts (roll paper) when using each payment terminal ・Provision of electronic slip service as an alternative to receipts (rolled paper)

・Use of environmentally friendly materials for payment terminal parts

・We repair payment terminals returned from member stores to ensure that they are of the same quality as new products, and provide alternative terminals in the event of a malfunction, etc.

Social

Human resources

We believe that the source of corporate value is diverse human resources. In order to create corporate value and solve social issues, we aim for sustainable growth by recruiting excellent human resources and enhancing various systems that contribute to improving the abilities of all partners*.

*Employees are called partners

Human resource development/welfare system

(Career design system)

A system in which each person declares how they think about their career and provides advice and support regarding career development.

(360 degree multifaceted evaluation system)

A system that allows partners to anonymously evaluate their superiors.

(Countermeasures to the falling birthrate)

Funds and benefits at each stage from marriage to childcare, special working conditions, etc.

Work style reform

Based on the idea that a company is a place where people are nurtured, all partners share the same vision for providing a place where they can maximize their abilities and for the organizational growth of the business and the company, and we are continuously working to reform the way we work, including the development of our own human resource development system and welfare programs. Specifically, we are working to reform work styles by promoting a telework work system that takes into consideration the safety of executives and employees, promoting the use of maternity and childcare leave, encouraging shorter working hour systems for childcare, and providing opportunities for reemployment after retirement.

Promotion of employment of people with disabilities

We promote the creation of a comfortable work environment by accepting diverse human resources. Under the special certification system for affiliated companies, we are striving to employ people with disabilities through collaboration with GMO Internet Group company "GMO Dream Wave".

Governance

Basic way of thinking

Our group aims to achieve fair and transparent management. To achieve this, we will build good relationships with all stakeholders, including our shareholders, customers, business partners, local communities, and employees, and promote management activities that aim to improve the group's corporate value from a long-term perspective.

Management efficiency, soundness, and transparency are essential to increasing the group's corporate value, and we believe that these are the basic elements of corporate governance and recognize them as important management issues. To this end, we are working to enhance corporate governance in compliance with laws and regulations by establishing a decision-making system that responds quickly and appropriately to changes in the business environment and a fair, transparent, and efficient business execution system, while maintaining appropriate relationships with all of our stakeholders.

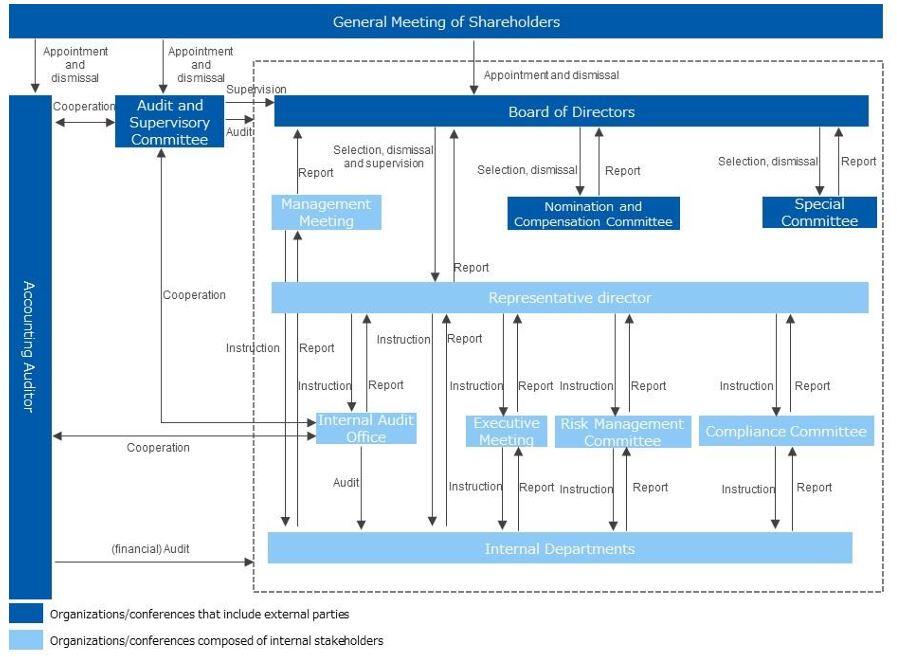

From the viewpoint of further enhancing corporate governance by strengthening the supervisory function of the Board of Directors, the Company plans to transition to a company with an Audit Committee System at the Ordinary General Meeting of Shareholders to be held on December 17, 2023. The following structure is based on the assumption that the proposal is approved as planned.

Corporate Governance Structure Chart

Board of Directors

The Board of Directors consists of nine directors (including four outside directors) and is positioned as the highest decision-making body to deliberate and decide on basic management policies, important decisions, and important matters stipulated by law. In principle, the Board of Directors meets once a month, and when important proposals arise, the meeting is held as necessary. The Company's Articles of Incorporation stipulate that the Company shall have no more than 11 directors.

Audit and Supervisory Committee

The Audit Committee consists of four members (including four outside directors) who are Audit Committee members, and in principle meets once a month, and other times as necessary. The Audit Committee members audit the execution of duties by directors (excluding those who are Audit Committee members) by attending meetings of the Board of Directors and other important meetings and by investigating business and financial conditions.

Management Meeting

The Management Meeting has been established as a body to deliberate and make decisions on important management matters that do not fall under the criteria for approval by the Board of Directors, thereby creating a system that enables flexible management decision-making. The Management Meeting is composed of executive directors and meets twice a month in principle, or as necessary.

Nomination and Compensation Committee

The Nomination and Compensation Committee is a voluntary committee concerning the nomination and compensation of directors and consists of five directors (including three outside directors). In principle, the Nomination and Compensation Committee meets four times a year. As an advisory body to the Board of Directors, the Nomination and Compensation Committee deliberates on director selection policies and compensation amounts from an objective and fair perspective, and reports to the Board of Directors.

Special Committee

The Special Committee is an advisory body to the Board of Directors and consists of four independent outside directors. The committee deliberates and reviews important transactions and actions that conflict with the interests of controlling shareholders and minority shareholders in order to protect the interests of minority shareholders and strengthen the governance of the Board of Directors.

Executive Meeting

The Executive Meeting, consisting mainly of executive directors and corporate officers responsible for business, meets once a week in principle to share the status and schedule of each business unit activity, align the vector of management activities under the direction of management, and ensure speedy business management and flexible organizational response.

Internal Audit Office

The Internal Audit Office has been established to conduct internal audits, and under the direction of the Representative Director, conducts necessary audits and investigations on a regular basis to extensively verify the appropriateness and efficiency of business execution and the status of compliance with and maintenance of the risk management system. The results are reported to the Representative Director, who manages the progress of the internal audit and other functions, and the results are reflected in the management. The Internal Audit Office has one full-time manager, and in accordance with the Internal Audit Regulations, employees outside the Internal Audit Office can be temporarily appointed as audit staff as needed to provide support.

Accounting Auditor

The Company has entered into an audit contract with EY Ernst & Young ShinNihon LLC, and in addition to regular accounting audits, the Company consults with and reviews important accounting issues as needed. There are no special interests between the Company and EY Ernst & Young ShinNihon LLC or its designated and engagement partners who audit the Company. No auditor has been with the Company for more than seven 7 years.

Risk Management Committee

The committee is chaired by a person appointed by the President and Chief Executive Officer, and includes risk management managers and risk managers from each department. The Risk Management Committee meets four times a year and whenever necessary. Led by the person in charge of risk management, the committee examines preventive measures to deal with risks surrounding the Company's management, including information leaks and disaster response, and conducts activities such as reviewing necessary business rules, improving information systems, and thoroughly educating employees. In addition, the Company has publicized and thoroughly enforced a reporting system within the Company in the event of an emergency situation.

Compliance Committee

We have established a Compliance Committee in order to achieve management efficiency in harmony with our management philosophy, further increase shareholder value, and fulfill our corporate social responsibility through fair management based on compliance with laws and regulations. In principle, the Compliance Committee meets twice a year to ensure proper business operations with an emphasis on protecting the interests of users of the Company's services, conducting fair transactions, developing a compliance framework, establishing an internal control system, and properly disclosing the status of management.

Executive compensation

The Company believes that the role of directors (excluding those who are members of the Audit and Supervisory Committee) is to enhance corporate value by formulating management policies and strategies for the entire Group, executing operations, and advising and supervising the execution of operations by employees. The Company believes that the role of directors (excluding those who are members of the Audit Committee) is to enhance corporate value by formulating management policies and strategies for the Group as a whole, executing operations, and advising and supervising employees in the execution of their duties. Based on this, the remuneration of directors (excluding those who are members of the Audit and Supervisory Committee) shall be determined based on their contribution to the Company and their performance. The Board of Directors determines the remuneration of Directors (excluding those who are members of the Audit and Supervisory Committee), taking into consideration their contribution to the Company, length of service with the Company, and contribution to the Company's business performance. On the other hand, remuneration for directors who are members of the Audit Committee is a fixed remuneration determined through discussions by the Audit Committee, which ensures their independence by ensuring that their remuneration is appropriate and not influenced by the company's performance.

Performance-based stock compensation plan (BBT)

The Company has adopted BBT (Board Benefit Trust) as a performance-linked stock compensation system for executive directors. This is an incentive plan in which shares are distributed to directors according to the degree of achievement of annual performance targets, and the company's directors share a sense of profit with shareholders from a medium- to long-term perspective and manage management with stock prices in mind. The content is motivating.

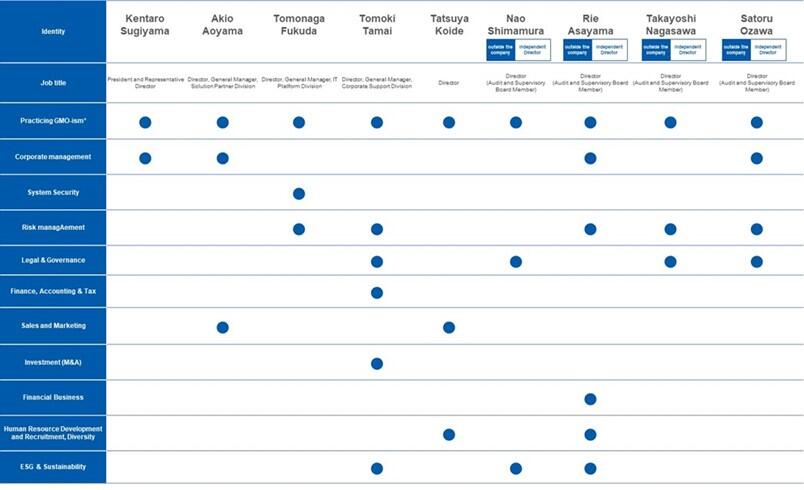

Board of Directors Members

Our governance structure is built around directors with backgrounds in technology and finance.

Skills Matrix of our board members

* GMO-ism refers to the "Spirit Venture Declaration," which is the unchanging goal of the GMO Internet Group. In addition to the “55-year plan,”' it is a general term for the company motto and motto that expresses “executive principles'” and “laws of victory”

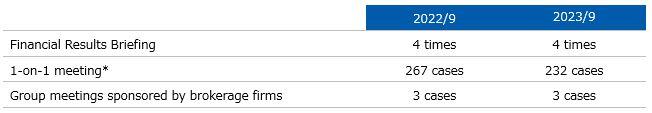

IR activities

In order to realize the purpose of corporate governance, we aim for more transparent and fair IR activities through timely disclosure of management information and dissemination of information to investors. Specifically, we will hold a financial results briefing session after quarterly results disclosure, and we will post the briefing materials on the TSE Timely Disclosure page and our website so that anyone can quickly check the contents. Doing. In addition, through meetings (1-on-1 meetings, group meetings) with securities analysts and institutional investors after the disclosure of business results, we strive to disclose information fairly and proactively so that the company's actual situation can be accurately understood and judged.

IR activity results

*1-on-1 meetings include brokerage-sponsored conferences (1-on-1 format)

External Awards

Selected as a 2023 Emerging Market Stock in the "Companies with Excellent Disclosure Selected by Securities Analysts". We will continue to commit to strengthening dialogue with the market at the management level.

ESG related data

Environment

*Targets are GMO Financial Gate, GMO Card Systems, and GMO Data, a consolidated group of companies.

*SCOPE 1, 2, and 3 will continue to conduct data verification by third-party verification organizations.

Social

*Number of partners refers to GMO Financial Gate, GMO Card Systems, and GMO Data, which are consolidated companies.

*Number of employee partners is the total number of regular employees, rehired employees, contract employees, and seconded employees (excluding employees seconded from the Group to outside the Group, but including employees seconded from outside the Group to the Group) as of the end of FY9/2023.

*"Number of temporary partners" is the average total number of part-timers and temporary employees over the past year.

*"Percentage of female employee partners" and "Percentage of female partners in management positions" are the figures for "employee partners.

*"Average years of service," "Average age," and "Turnover rate" are non-consolidated figures for GMO Financial Gate.

*Turnover rate excludes contract and temporary partners from FY09/2023.

Governance

The Company plans to transition to a company with a Audit and Supervisory Committee on December 17, 2023. This item shows actual results for the fiscal year ended September 30, 2023 (when the Company had a Audit Committee), before the transition.。

* For Director Tamai, General Manager of Corporate Support Division, who assumed office during the term, the number and rate of attendance since his assumption of office are shown.

関連リンク